Frequently asked questions

Understanding the Difference Between Everen Specialty Ltd. and Everen

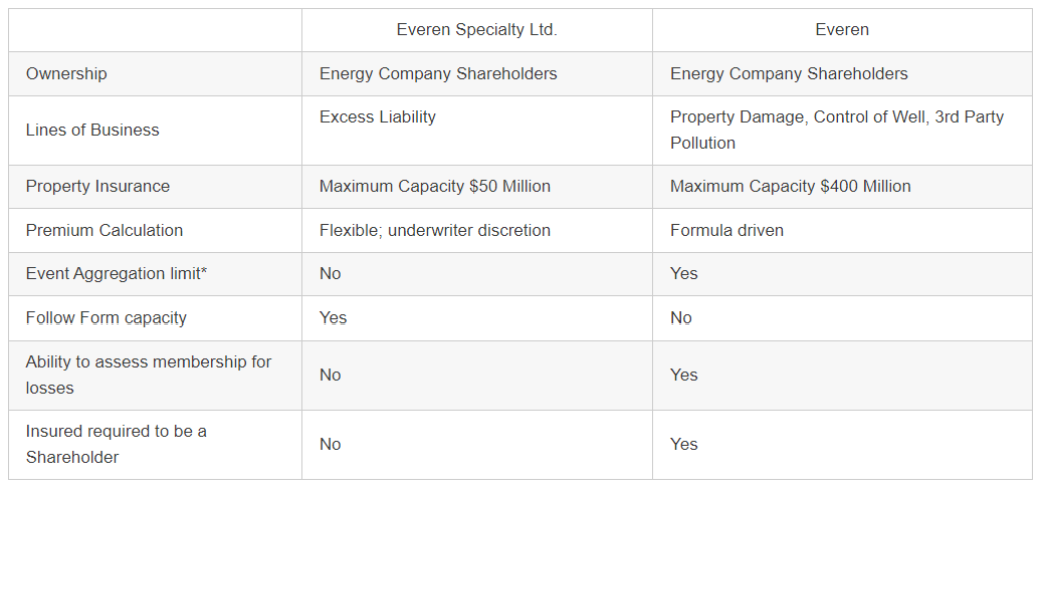

Two separate and distinct companies

Separate Board of Directors

There are no financial guarantees or indemnifications between the two companies

Membership is mutually exclusive – do not have to be a Shareholder of one to join the other, however a percentage of Everen Specialty Ltd. members are also Everen members

Similarity – both companies are managed by the same management company, Everen Group

* Unlike Everen that has a single event aggregation limit, shared among its insureds, Everen Specialty Ltd. does not

Shareholder Information

Everen Specialty Ltd. is focused on the energy industry and offers energy insureds an opportunity to become a Shareholder in the Company.

Shareholders

Are invited, with qualified expenses reimbursed by the Company, to the General Meetings of the Company, thereby having a say in the future direction of the Company and joining peers in networking opportunities to enhance risk management and insurance buying decision making.

Are encouraged to serve on the Board of Directors of the Company

Accumulate voting rights (capped at 9.5%), based on premiums earned

Vote on items presented at General Meetings of Shareholders

Qualify for a monetary distribution in the event of declared dividends or dissolution of the Company

To become a Shareholder, one must purchase a minimum of $25 million in limits, complete a Shareholder Application and Information Form (attached) and purchase one (1) share for US$5,000 (or the foreign currency equivalent)

If a Shareholder no longer purchases a policy or elects to terminate their shareholder status, the Company will refund the US$5,000 share price without interest. Although becoming a Shareholder is generally decided at the time of binding, an eligible policyholder can convert to a Shareholder at any time yet past premiums cannot be used in calculating voting and dissolution rights.

It is important to note that Everen Specialty Ltd. is a non-assessable mutual; Shareholders cannot be assessed for anything other than premiums.